per capita tax meaning

It means to share and share alike according to the number of individuals. Per stirpes and per capita are two different ways of distributing assets in a will.

Morocco Gdp Per Capita 1960 2022 Ceic Data

For example while both Bangladesh per capita income of 1693 and the Netherlands per capita income of 42183 had an income Gini coefficient of 031 in 2010 the quality of life economic opportunity and.

. By or for each individual a high per capita tax burden. Per capita is a Latin phrase meaning by head Its used to determine the average per person in a given measurement. Is this tax withheld by my employer.

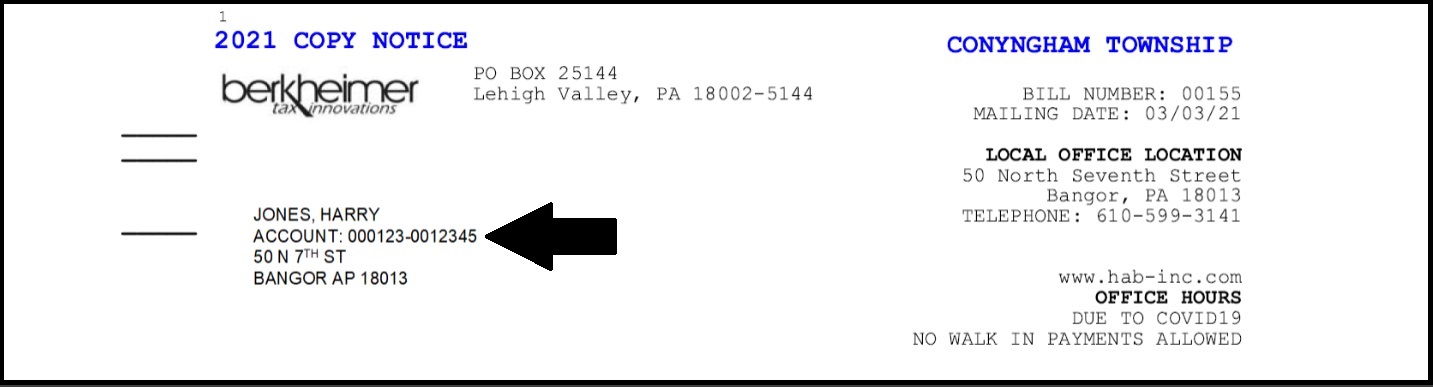

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. The Latin word Capita means head while Per is Latin for by or by means of. In economics it is common to.

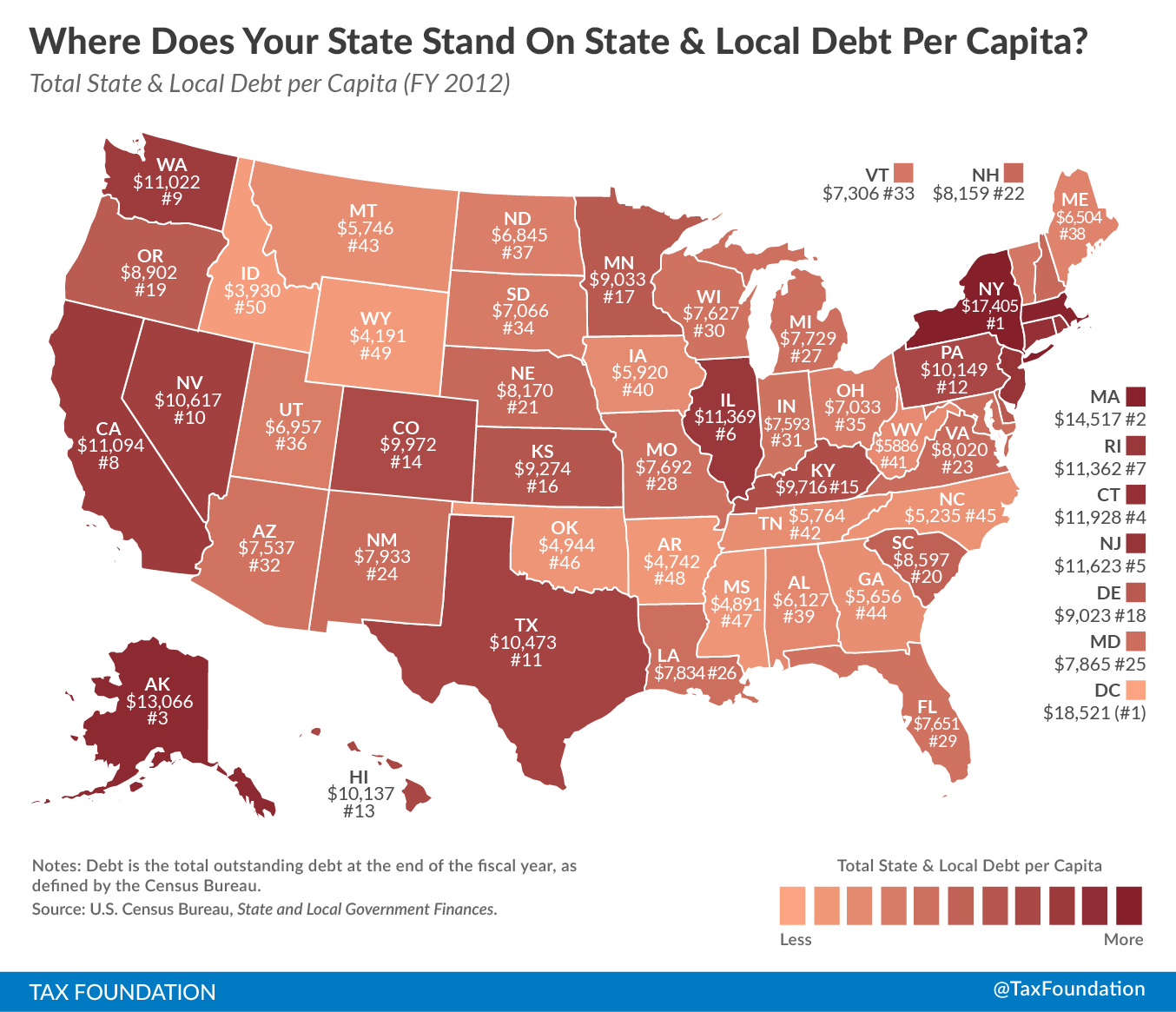

The nations lowest per capita property tax collections are in Arkansas 699 Oklahoma 678 and Alabama 540. 58 countries High-income countries GNI per capita greater than 12376 per year. Medium-high-income countries GNI per capita 3996 to 12375 per year.

Gini coefficients are simple and this simplicity can lead to oversights and can confuse the comparison of different populations. Income per capita is a measure of the amount of money earned per person in a certain area. The definition of GDP per capita is when the GDP is divided by the countrys population to show the national breakdown of a countrys economic output in relation to its population.

Do I pay this tax if I rent. However if you do not have a trust or will beneficiary designations can be set on taxable accounts to direct how that money gets divvied up at death just like with retirement accounts. While property taxes inevitably draw the ire of some residents living in high-tax jurisdictions they are largely rooted in the benefit principle meaning property taxes can be viewed as a payment for public services.

Both taxes are due each year and are not duplications. Prepared by the author with data from the IMF. Per stirpes per capita and similar designations typically apply to retirement accounts and not taxable accounts because those fall under your trust or will.

Per capita also means per person and According to Berkheimer Tax Innovations The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. Per unit of population.

What is the Per Capita tax. Per capita evenly divides an estate among the surviving beneficiaries while per stirpes allows assets to pass to the next generation if a beneficiary has already passed. What is a Per Capita tax.

Per Capita means by head so this tax is commonly called a head tax. It is not dependent upon employment. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent.

The terms minor and legal incompetent have the same meaning as in 25 CFR 2902 re- lating to review of Indian tribal revenue al- location plans adopted under IGRA04 Per capita payment. On average state and local governments collected 1556 per capita in property taxes nationwide in FY 2016 but collections vary widely from state to state. The school district as well as the township or borough in which you reside may levy a per capita tax.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. The gross domestic product per capita or GDP per capita is a measure of a countrys economic output that accounts for its number of people.

60 countries We analyze the relationship between tax burdens and per capita income separately for each group of countries. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Learn what the GDP is and how a countrys overall GDP doesnt always accurately show how prosperous a country is for. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. This is an especially useful financial indicator because it gives economists a viable comparison of different countries economic performance.

Due to return processing delays relating to the erroneous assertion of self-employment tax on per capita distributions to tribal members the Service has developed a solution which involves wording that must be entered on Line 21 of Form 1040. The highest state and local property tax collections per capita are found in the District of Columbia 3535 followed by New Jersey 3127 New Hampshire 3115 Connecticut 2927 New York 2782 and. It means per person or per head of the population.

Per capita is a common term used in economics human geography and statistics. What is the Per Capita Tax. For example a common way in which per capita is used is to determine the gross domestic product GDP of a population per capita.

Normally the Per Capita tax is NOT. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. If you express an.

It can apply to the average per-person income for a city region or country and is used as a means of. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will. It divides the countrys gross domestic product by its total population.

If you express an amount per capita you mean that amount for each person. Estate planning is one of the most critical pieces of the financial planning puzzle. Per capita payment aspects of plans and protection of funds accruing to mi- nors legal incompetents and deceased beneficiaries.

Information About Per Capita Taxes York Adams Tax Bureau

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

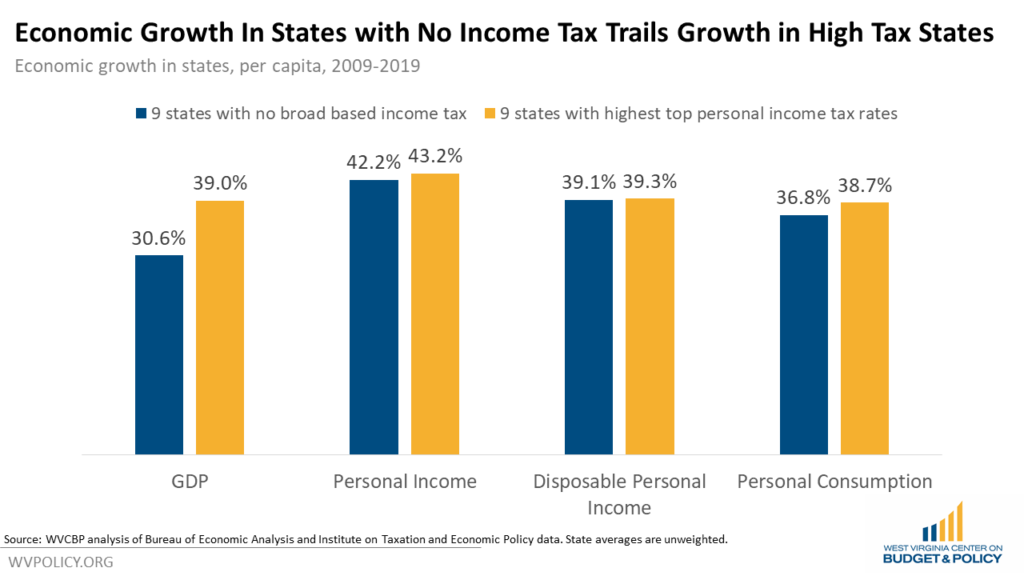

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

State Local Property Tax Collections Per Capita Tax Foundation

Indonesia Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Vietnam Gdp Per Capita 2021 Data 2022 Forecast 1984 2020 Historical Chart

Regional Household Income Statistics Statistics Explained

Chapter 6 Implementing A Medium Term Revenue Strategy In Realizing Indonesia S Economic Potential

Pdf Tax Revenue Expenditure And Economic Growth An Analysis Of Long Run Relationships

Catching Elusive Taxpayers Still A Work In Progress

Indonesia Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Why It Matters In Paying Taxes Doing Business World Bank Group

Pdf Tax Revenue Expenditure And Economic Growth An Analysis Of Long Run Relationships

U S Per Capita Consumption Of Soft Drinks 2018 Statista

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)